Types of Business Accounts

Small and medium businesses can take advantage of our Business Checking, featuring a range of services to help keep you moving forward efficiently. Bigger businesses can depend on our dedicated services through a Commercial Analyzed Checking. Read more about each type of account and tell us what works best for you.

$100

$9 (may be reduced to $0 with available discounts).

N/A

100 Items Per Statement Cycle1

($0.20 per item over 100)

$100

$12 Monthly Maintenance Fee

Above $5,000

325 Items Per Statement Cycle1

($0.25 per item over 325)

$100

$10

N/A

$0.15

N/A

$25

FREE

N/A

250 FREE Transactions per month

$100

FREE

N/A

250 FREE Transactions per month; Plus 2 FREE Cashier’s Checks per month

FREE 3x5 Safe Deposit Box

$25

FREE

N/A

100 FREE Transactions per month

All Accounts Include:

Instant Issue Debit Card

Free In-Network ATMs2

Online3 and Mobile Banking4

Notary Services

Quicken & Quickbook Files

E-Statements5

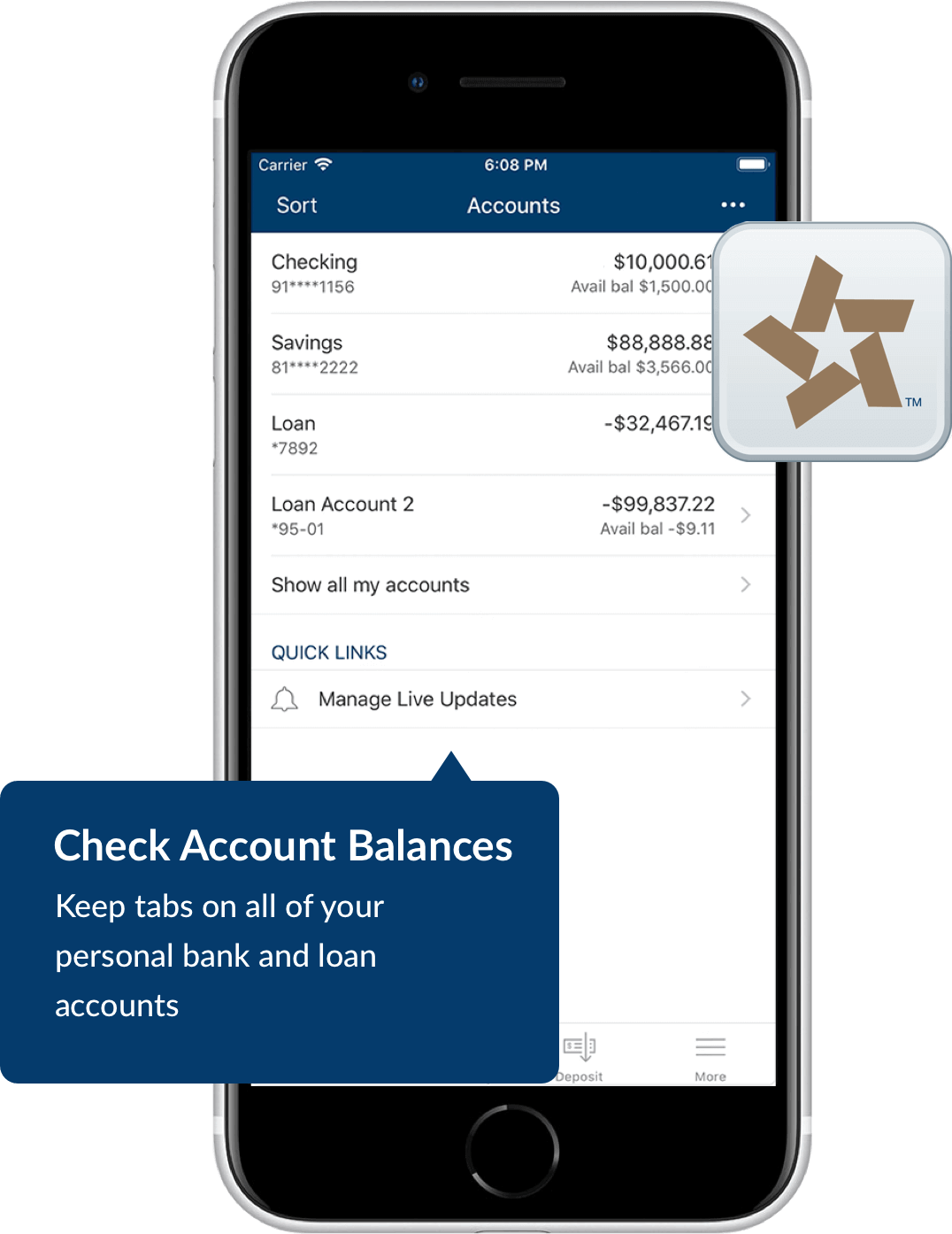

Bank on the Go with the TRB Business Mobile App

Texas Regional Bank’s Business Mobile Banking solutions allow you to access your business accounts with your mobile device any time you want from wherever you are. Bank conveniently, securely and manage your business finances anytime, anywhere - from your mobile device.

For more information about FDIC insurance coverage visit: www.fdic.gov

(1) Transaction items include a combination of deposits, deposited items, checks, debits and credits. Electronic items are not included in transaction item total. (2) Free ATM withdrawals at Texas Regional Bank ATMs and Stripes® Stores. See website for locations. (3) Online Banking required. Carrier message and data rates may apply. (4) Terms and conditions apply, must qualify for service. (5) Requires you to be an Online Banking customer. $4.00 for printed image statement. (6) Organizations must be tax-exempt under section 501(c)(3).

Other account and service fees may apply. Please refer to our Truth in Savings Disclosure, Privacy Policy, and Terms and Conditions for further information.